Comprehensive Business Insolvency Company Provider to Browse Debt

Comprehensive Business Insolvency Company Provider to Browse Debt

Blog Article

Explore the Trick Conveniences and Advantages of Using Insolvency Providers for Your Financial Scenario

Browsing economic obstacles can be a complicated job, especially when faced with insurmountable debts and unpredictable fiscal futures. These specialized services provide a range of solutions designed to reduce the burden of debt, restructure monetary responsibilities, and lead the method in the direction of an extra secure financial structure.

Comprehending Insolvency Solutions

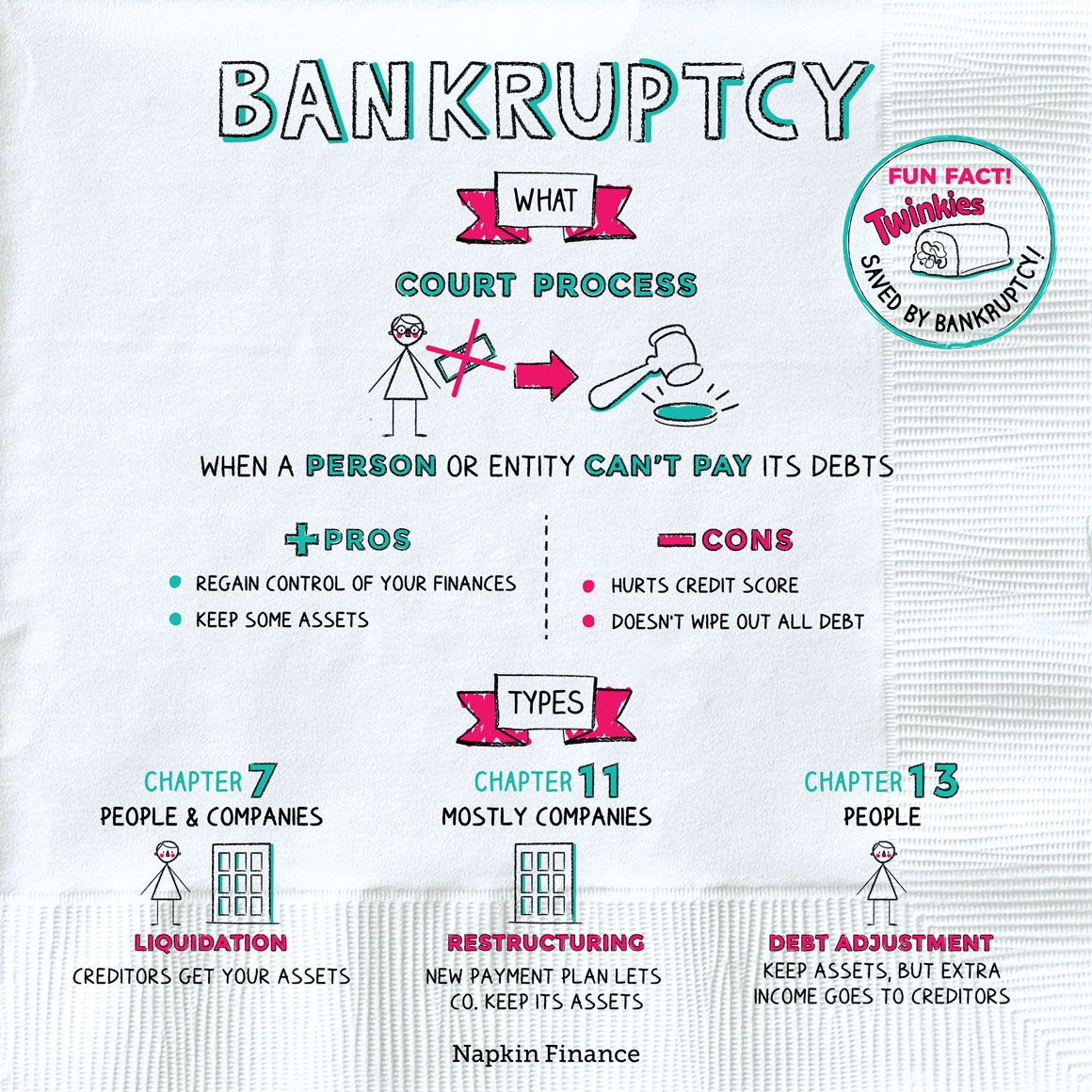

When encountering economic difficulties, businesses and individuals can take advantage of comprehending insolvency solutions to browse their scenario properly. Bankruptcy solutions include a variety of services developed to help people and services address financial challenges and reclaim security. These solutions frequently include debt restructuring, arrangement with creditors, asset liquidation, and insolvency proceedings.

By seeking aid from insolvency experts, individuals can acquire a clear understanding of their monetary choices and develop a calculated plan to resolve their financial obligations. Bankruptcy professionals have the experience to evaluate the economic situation, determine the origin causes of the bankruptcy, and advise the most appropriate training course of activity.

Furthermore, recognizing insolvency services can provide individuals with beneficial insights right into the lawful ramifications of their financial situation. This expertise can help people make informed choices about exactly how to continue and safeguard their passions throughout the bankruptcy process.

Financial Obligation Consolidation Solutions

Exploring efficient debt consolidation options can provide people and companies with a streamlined approach to handling their financial responsibilities. Financial obligation consolidation includes integrating numerous debts into a solitary financing or payment plan, typically with a reduced passion price or expanded settlement terms. This approach can aid simplify finances, reduce the risk of missed settlements, and potentially reduced monthly settlements.

One common debt loan consolidation remedy is a financial obligation consolidation finance, where people or companies obtain a lump amount to settle existing financial obligations and then make solitary monthly repayments towards the new car loan. Another option is a financial debt administration plan, where a credit scores counseling firm discusses with financial institutions to reduced rate of interest rates or waive fees, permitting the borrower to make one consolidated monthly payment to the agency.

Bargaining With Financial Institutions

Bargaining properly with financial institutions is an essential step in resolving monetary difficulties and finding possible remedies for financial debt repayment. When dealing with insolvency, open communication with creditors is vital to reaching equally useful agreements. By launching discussions with financial institutions early on, people or businesses can demonstrate their readiness to deal with the financial debt issue properly.

Throughout settlements, it's important to provide financial institutions with a clear overview of your financial scenario, consisting of earnings, costs, and properties. Transparency develops trust fund and enhances the probability of getting to a favorable outcome. Furthermore, suggesting practical settlement strategies that consider both your financial capabilities and the lenders' passions can bring about effective agreements.

Personalized Financial Assistance

Developing a solid foundation for monetary recuperation involves seeking individualized financial support tailored to your particular circumstances and look at this site objectives. Business Insolvency Company. Customized monetary advice plays a vital duty in navigating the complexities of insolvency and developing a strategic plan for reclaiming economic security. By functioning carefully with a monetary consultant or insolvency expert, you can acquire important insights right into your economic scenario, recognize locations for improvement, and create a roadmap for achieving your financial objectives

Among the vital advantages of personalized economic advice is the possibility to obtain customized advice that considers your unique financial situations. A monetary expert can assess your revenue, assets, expenditures, and financial obligations to offer tailored referrals that align with your objectives. This personalized strategy can help you make educated decisions, prioritize your financial obligations, and create a lasting financial plan for the future.

Furthermore, individualized economic advice can use recurring support and liability as you work towards improving your monetary situation. By partnering with a knowledgeable expert, you can gain the self-confidence and expertise needed to conquer economic challenges and build a stronger financial future.

Path to Financial Recovery

Navigating the journey towards financial recovery requires a tactical method and disciplined financial management. To begin on this course effectively, people have to initially analyze their existing financial situation adequately. This includes comprehending the level of debts, examining earnings resources, and identifying costs that can be cut to reroute funds towards debt repayment or cost savings.

As soon as a clear image of the financial landscape is established, developing a realistic spending plan comes to be critical - Business Insolvency Company. Budgeting allows for the allowance of funds towards financial debt settlement while ensuring that crucial costs are covered. It also works as a tool for tracking progress and making essential changes along the way

Conclusion

Finally, making use of bankruptcy services uses various advantages and advantages for people encountering financial problems. These services give financial obligation combination solutions, aid bargain with lenders, offer individualized economic assistance, and pave the way in the direction of economic healing. By seeking insolvency services, people can take proactive steps towards improving their economic circumstance and achieving long-lasting security.

By working collaboratively with companies, people and lenders can browse challenging monetary circumstances and pave the method towards a view much more stable economic future.

One of the crucial benefits of individualized financial advice is the opportunity to get customized guidance that considers your one-of-a-kind financial scenarios. These solutions offer financial debt consolidation options, aid negotiate with lenders, supply personalized monetary support, and lead the way towards monetary recuperation.

Report this page